Ukrainian state legislation defines finance leasing as a financial service. As in many countries, financial services in Ukraine are regarded as socially and economically important and draw attention from the State institutions. Thus finance leasing in Ukraine requires to have a license, is monitored by the regulatory institution for this market in accordance with the legislation and regulatory framework. As described above, starting from July 1, 2020, all entities involved in provision of finance leasing services are monitored and regulated by the NBU.

At the same time, operating leasing is not defined as a financial service. Due to this reason, operating leasing activities do not require to have a license, they are not specifically regulated, reported or monitored. Thus, it is difficult to identify the specific volume of operating leasing.

According to the data of the Ukrainian Union of Lessors (the Association which represents the finance leasing industry), Ukrainian leasing market is dominated by finance leasing. Nevertheless, operating leasing exists in Ukraine and is mostly common for car leases.

We will be focusing on finance leasing further in this article due to the described reasons.

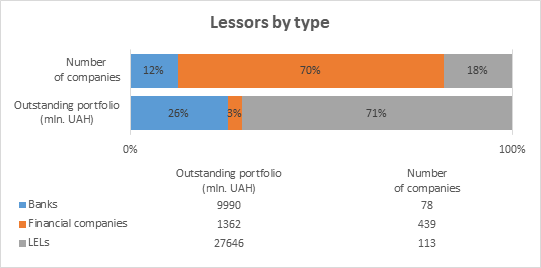

There were three main group of actors on the market until recently: (1) banks, (2) financial companies. (3) legal entities, which are not financial institutions, but have the right to provide finance leasing services (hereinafter LEL). Banks and financial companies are allowed to provide finance leasing automatically once they registered as financial institutions. LELs did not have to register as financial institutions, but were allowed to provide leasing services once they obtained a license for these operations. The NBU plans to change this system in the near future, by introducing a requirement for LELs to register as financial institutions as was described above. Nevertheless, in the current market overview we will be providing information for these three groups separately.

There were 630 institutions at the end of 2019 that had the right to provide finance leasing services in Ukraine. This number included 78 banks, 439 financial companies, and 113 LELs.

As of January 1, 2020 the value of the outstanding finance leasing contracts amounted to 38 997 mln UAH (about 1 651 mln USD). While 70% of the institutions licensed to provide finance leasing are financial companies, they are only responsible for about 3% of the total portfolio value. Another 26% of the portfolio value is in the hands of banks. Both of this groups of market players do not consider this activity as their primary business.

The most active group on the leasing market remains the LELs. In sheer number, they constitute only 18% of all the institutions licensed to operate on this market, but they hold 71% of the total value of the outstanding leasing portfolio.

Most active institutions operating on the market are members of the Association “Ukrainia Union of Lessors”. The members of this organization have a market share of about 80%.

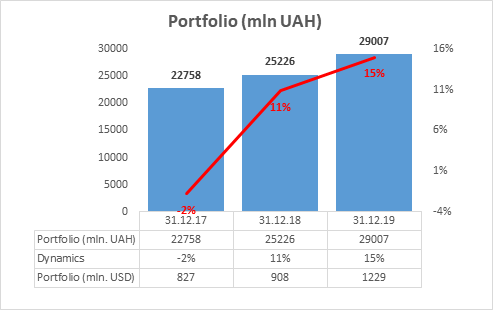

Information on the leasing activities of the banking sector were not public until recently. At the same time, historic data on the non-banking leasing sector is readily available. It shows that the portfolio of this sector while still in decline in 2017 (which was the continues trend after the crisis of 2014-2015), started growing in 2018 by 11% and the growth dynamics even accelerated in 2019 to 15% y-o-y.

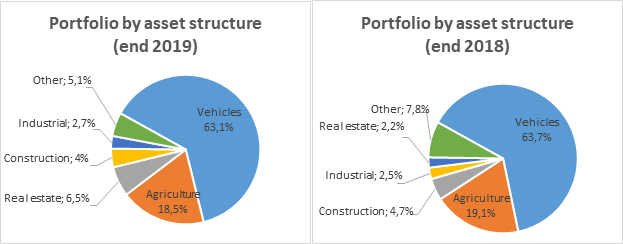

The Ukrainian non-banking leasing market is traditionally most focused on leasing of vehicles. Value of this type of assets constituted 63% of the outstanding portfolio in the end of 2019. Agricultural equipment has also a noticeable 18.5% share in the portfolio. Together these two groups formed over 80% of the leasing portfolio as of end of 2019.

Outside of transportation and agriculture, the leasing portfolio included the following types of assets as of end of 2019: real estate (6.5%), construction equipment (4%), and industrial equipment (2.7%). We do not observe significant changes in the asset structure of the leasing portfolio in Ukraine in the past couple of years.

The largest number of leased vehicles in Ukraine is cars. According to the latest data collected by the Ukrainian Union of Lessors among its members, this group constituted about 83% of all vehicles registered by leasing companies within 1H2020. Another 8% were trucks, LCVs had about 5%. Other vehicle types had a share below 5%.

Penetration rate of leasing into the car market is 13%, and 11.4% into the market of LCVs.

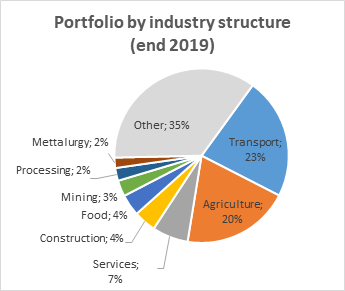

The structure of the leasing portfolio by industry as of end of 2019 shows that transportation (23%) and agriculture (20%) are the most common industries that use leasing services in Ukraine. Those two industries together account for 43% of the leasing portfolio as of end 2019. Still present, but at much lower share, are the service industry (7%), construction (4%), food (4%), mining (3%), processing (2%), metallurgy (2%). Such concentration of leasing in transportation and agriculture does not correspond to the structure of the economy in general and is rather indicative that the leasing industry has a lot of potential for growth and diversification into other sectors of economy.

Businesses are the dominant client of the leasing industry. Legal entities are responsible for over 88% of the value of assets leased in 2019. Individuals leased only 10% of the assets.

The currency of the finance leasing contract can be set in Ukrainian national currency (hryvnia), or in hryvnia linked to USD and EUR exchange rate. Depending on the chosen currency scheme, the interest rate varies. The interest rate for contracts set in hryvnia can be up to 26%, it can be up to 12% for contracts in hryvnia linked to USD, and up to 11% when linked to EUR.

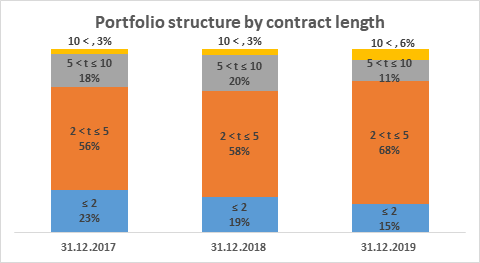

Most commonly, the leasing contract in Ukraine is signed for 2 to 5 year contract. After the Ukrainian economy achieved macro-economic stabilization and GDP growth, the average length of the leasing contract started to shift even further from short term contacts (2 years or less), to midterm (2 to 5 years).

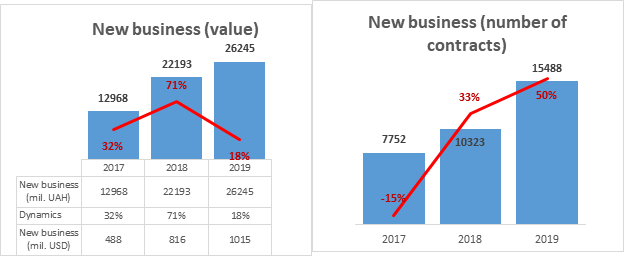

The non-banking leasing sector has seen continues growth of the value of new business in the past three years. It has reached the values of 26.3 billion UAH (about 1 billion USD) in 2019 after growing by 18% compared to last year. The growth in 2018 was even higher and constituted 71%, while in 2017 it was 32% YoY.

The number of signed contracts per year is also growing two years in a row, with 33% growth in 2018, and 50% growth in 2019. The number of contracts has reached 15.5 ths in total number.

Both those trends are indicative of improving and intensifying economic activity in the country in general. But since the leasing industry is outpacing the growth of the economy of Ukraine in general, it could be safely stated, that it is one of the drivers of economic growth.

The total value of capital investments in Ukraine has reached 584 billion UAH (about 22.6 billion USD) in 2019. They have grown by 27% in 2018 and by 11% in 2019. The penetration rate of leasing into capital investments in the country was 5.83% in 2019 and went down from 6.52% that was a year earlier.