Source

Author: Julia Ovdiy

Financial services is a sector where effective and high-quality regulation is critical to the well-being of consumers, to businesses and the economy in general. It is vital to ensure that consumers are well informed about the products and services they purchase and that financial institutions are treated fairly.

Recently, financial institutions and regulators have used the term “market behavior” in the Ukrainian financial market. He is most often used when it comes to consumer protection, corporate governance, ethics and more. However, such a generalization is not entirely correct. Therefore, in this article we will try to find out what is market behavior and what are the features of its regulation in the world and in the financial market of Ukraine.

Areas of regulation of the financial market

For a clearer understanding of what place market behavior takes in the system of financial markets regulation, let us first consider this system and its components.

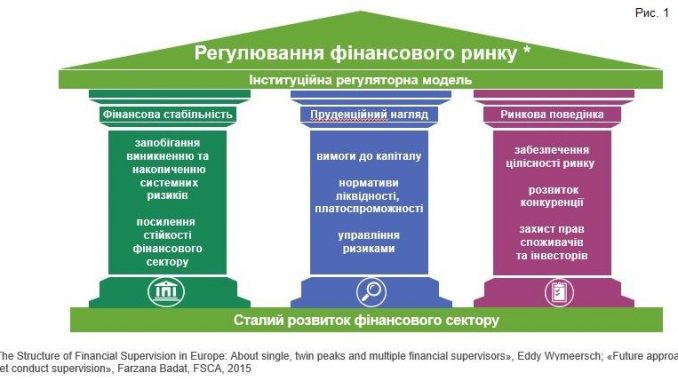

In the system of regulation of the financial market of each country there are three separate directions ( Fig. 1 ):

1. Prudential supervision.

2. Ensuring financial stability.

3. Regulation of market conduct (financial conduct ) of financial market participants.

For a long time, much attention has been paid to prudential (microprudential) supervision in this system, which is based on regular assessment of the financial condition of a financial institution, the performance of the system and the quality of its management, compliance with mandatory standards and other indicators and requirements that limit the risks of operations with financial assets.

Following the global financial crisis of 2007–2008, policymakers around the world have focused on analyzing the preconditions and developing remedies identified in the financial regulatory environment. Many regulatory authorities have launched substantial systemic reforms. A global effort was also coordinated to look for more effective risk management measures in the financial sector (especially systemic risk) at the national and international levels.

Against the background of the global financial crisis, the “macroprudential concept” has become widespread. Macroprudential policy assumes that systemic risks can be triggered by various factors (exogenous and endogenous), but often arise from the collective action of individual financial institutions. Accordingly, other tools have been developed to prevent risks or at least reduce their impact.

As the experience of the crisis has shown, compliance with basic standards by individual institutions is not an absolute guarantee that systemic risks to the financial sector are minimized. As a result, the central banks of the world began to set up separate financial stability units specialized in macro-prudential analysis and regulation, and another function emerged in regulating the financial markets of the world – providing financial stability.

Another important area that has been given special attention in the post-crisis period is the regulation of market behavior (RP).

There is no unified global definition of market behavior in the world . Different jurisdictions use terms such as:

- “Conduct of business regulation”,

- “ Market conduct regulation ”,

- “Retail regulation ”.

However , market surveillance is at least based on:

- rules of transparency (transparency),

- integrity of the market,

- rules for selling financial services and resolving disputes.

FP frameworks and EU experience

The Financial Inclusion Alliance (AFI), in its Market Behavior Oversight Guidelines, defines the market behavior of financial service providers as approaches that the provider uses in developing financial services and in managing customer and public relations, including the use of intermediaries (agents or agents) ). RP is influenced by many factors, including:

- Institutional frameworks are the legislation, infrastructure and institutions needed to maintain transparent, competitive and fair markets.

- Supply factors are established business culture and financial services delivery, best practices and behavior of financial service providers (PFPs). Regarding supply, regulators protect the public from unfair market practices, setting requirements and controlling the entry of financial institutions, market activity and entry through licensing, monitoring of on-site inspections and other control processes. Taken together, these regulatory practices are market behavior regulation and supervision.

- Demand factors include consumer expectations, consumer confidence and financial capacity.

Regulators use market behavior policies to strengthen these three factors and create a more sustainable, equitable and reliable financial ecosystem for consumers.

To get a closer look at how market behavior is monitored in the European Union, let us look at the jurisdictions where a functional Twin Peaks financial market surveillance model is built. It means that the division of powers between regulators is carried out according to the tasks / functions overseen by all segments:

- systemic risk regulator (prudential regulator);

- financial conduct regulator (market conduct regulator).

In countries with the Twin Peaks model, the function of regulating market behavior is exercised by a separate regulator. In the EU, it is the United Kingdom, Belgium, the Netherlands.

Let’s look at the functions they perform in the process of regulating and supervising market behavior.

United Kingdom

The Financial Conduct Authority (FCA) is the FCA’s strategic goal. The FCA’s strategic goal is to ensure the proper functioning of the relevant markets, and the operational goals are:

- improving the integrity of the financial system;

- promoting competition;

- consumer protection.

To ensure the integrity of the FCA financial market :

- oversees the behavior in the wholesale market;

- regulates the securities market;

- develops regulations to protect markets: Code of Market Conduct, which describes the requirements for the business conduct of NFP;

- describes behaviors (including employee requirements) that are or are not related to market abuse (factors that need to be taken into account to determine whether behavior is market abuse);

- enforces regulations to remedy market abuse (spreading false information or leaking insider information);

- facilitates the establishment of RPs at the institutional level: NFPs must have the right people in the right roles who work for the benefit of consumers;

- take action to combat financial crime: NFPs must have appropriate systems and controls in place to prevent the risk that they may be used for financial crime.

The second area in the WP is to promote competition . For this purpose, the FCA:

- helps consumers to obtain the necessary information from NFP;

- commits NFP to providing consumers with quality information about products and services that can enable them to make effective decisions about their choices;

- Ensures fair competition for NFPs: ban cartels and other potentially anticompetitive agreements, prevent abuse of dominant position;

- facilitates the entry into the financial services market of new NFCs;

- encourages innovation in financial services: launching an innovative hub, sandboxing.

In the process of fulfilling the third important component of the RP – consumer protection – the FCA performs the following tasks:

- ensuring that NFP clients are a business priority, that NFP provide them with relevant products and services and put their protection above their own profits or revenues;

- observing which NFPs may be participants in the financial market, ensuring that they meet the established standards, and terminating the activities of those who do not meet those standards;

- Continuous information support to consumers: features of different products and services, operating financial institutions, ways and procedure for complaints, consumer rights in the process of dispute resolution.

Belgium

The Financial Conduct Authority is FSMA ( Financial Services and Markets Authority ). The FSMA’s competences fall into the following six areas:

1. Observation of financial markets and control of financial information dissemination by NFP.

FSMA verifies that information distributed by registered companies is fully and timely provided. In addition, FSMA guarantees that all shareholders of the licensed company are treated equally.

2. Supervision of observance of rules of business conduct.

Financial institutions should have appropriate arrangements in place to ensure that consumers of financial services and products are treated with due care and attention. This means, among other things, providing the NFP with correct information, proper management of potential conflicts of interest, and the best execution of customer instructions. In addition, financial institutions may only sell products that meet the customer risk profile.

3. Supervision of products and services.

Supervision of financial products is intended to ensure that the products offered to consumers are understandable, useful, have an acceptable level of risk for investors and comply with the relevant laws and regulations. FSMA initiates the creation of simple and understandable financial products. There are two ways to control the product: through quality control of information and promotional material relating to products and services and monitoring compliance with the conditions governing the products themselves.

4. Supervision of NFP.

FSMA is responsible for overseeing a wide range of NFPs: banking and investment intermediaries as well as insurance and reinsurance intermediaries (agents and brokers), mortgage and consumer loan providers and mortgage and consumer loan brokers, portfolio management, investment advisory companies; currency exchange points.

5. Supervision of supplementary pension.

The FSMA monitors compliance with second-level social security laws, and monitors the financial status of occupational retirement institutions that manage supplementary retirement plans.

6. Participation in improving financial education.

Improving consumer financial knowledge can help restore their confidence in the financial system. FSMA has created a dedicated service responsible for this task.

Netherlands

Financial Conduct Authority – AFM (The Dutch Authority for the Financial Markets). The AFM mission has three strategic goals:

- Promote fair and honest provision of financial services.

AFM controls financial institutions in the areas of savings, loans, investments and insurance. Supervision focuses on financial products and services and the ethical business behavior of financial institutions. AFM helps create the conditions for consumers, private investors, professional and semi-professional participants to make well-informed financial services decisions based on comprehensible information and appropriate service delivery.

- Promoting the fair and efficient functioning of the capital markets.

Investors, as well as other parties operating in the capital markets, should be able to rely on the fact that the capital markets operate in a fair and efficient manner. The oversight is to determine that companies operating in the capital markets provide timely and accurate information, and that the auditors who are required to assess the reliability of the financial statements perform this task correctly. AFM helps create an environment where investors can make fair and informed decisions.

- Promoting the stability of the financial system.

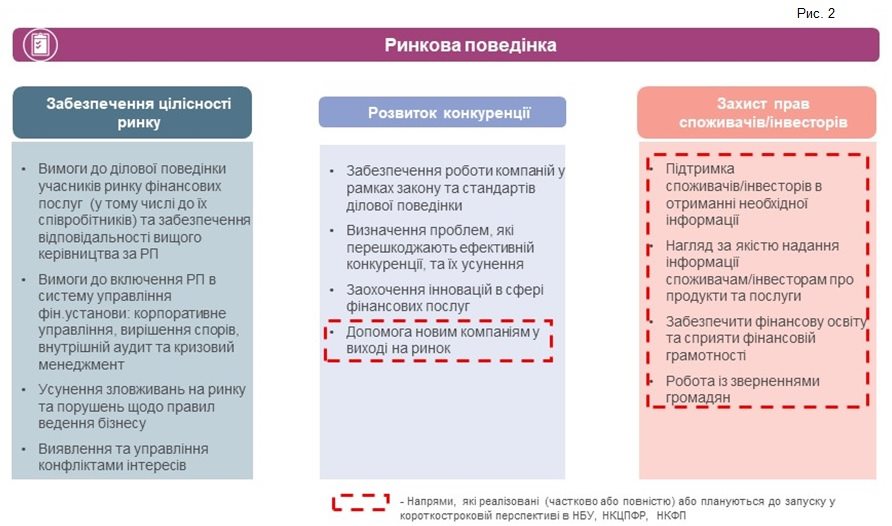

Together with the Central Bank, AFM creates the preconditions for a financial system with managed and transparent risks. AFM controls the orderly functioning and stability of the financial infrastructure. Considering the activities of regulators in the UK, Belgium and the Netherlands, which regulate market behavior, each of them can clearly distinguish their features, but there are common tasks and functions that they perform. In the process of regulating market behavior, there are three main areas ( Fig. 2 ).

State of regulation of market behavior in Ukraine

Let us return to the components of the financial market regulation system identified at the beginning of the article and analyze how they are regulated in Ukraine.

Therefore, three regulators are responsible for prudential supervision of the financial services market in Ukraine:

- National Bank of Ukraine (NBU).

- National Commission for the State Regulation of Financial Services Markets (NCFP).

- National Securities and Stock Market Commission (NSSMC).

Ensuring financial stability is a mandate of the NBU, and the function of supervision and regulation of market behavior of financial market participants is absent from any of them.

It is worth noting that in Ukraine the issues related to the protection of the rights of consumers of financial services have begun to be considered, but this is being done only for certain services. Thus, in 2016 the Law of Ukraine “On Consumer Lending” was adopted. The main purpose of this document is to create such a consumer lending mechanism that will protect the rights and legitimate interests of both consumers and creditors in this field, create a proper competitive environment in the financial market, increase the level of public confidence in it, provide favorable conditions for the development of the Ukrainian economy .

However, there are cases where the provisions of the law do not apply:

- Loans extended to consumers with a maturity of up to one month;

- credit agreements, the amount of credit for which does not exceed one minimum wage on the day of conclusion of the contract;

- loan agreements that do not provide for interest or other payments for the use of funds;

- loans provided by pawnshops in the case of the transfer of the collateral to the pawnshop, provided that the consumer’s obligations are limited by the value of the collateral.

This creates loopholes for financial institutions. That is, they can bypass the requirements of the law without directly breaking it. In addition, this law is not implemented by many financial institutions, because it does not stipulate sanctions for its failure. Also in the Verkhovna Rada two bills have been registered for a long time:

- “On Amendments to Some Legislative Acts of Ukraine on Improving the Protection of Consumers’ Rights of Financial Services” No. 2456-e

- “On the establishment of the Financial Ombudsman” No. 8055.

The first bill proposes to provide the financial market regulators (NBU, NCSSMC, NCFP) with the necessary enforcement tools (inspections, cases, penalties, etc.) for violations of the law and consumer rights, the second proposes to create a financial ombudsman institution as a mechanism for pre-litigation between disputes and arising disputes between the public financial institutions. But protecting consumer rights is just one of the areas of regulation of market behavior. It cannot be effectively implemented without the other two.

Effective regulation of market behavior is possible only through a combination of three compulsory factors:

(1) legislation and institutions that control its implementation;

(2) an established business culture and financial services, best practices and NFP behavior;

(3) consumer expectations and confidence.

The need for effective and transparent regulation of financial services is enshrined in the Association Agreement between Ukraine and the EU, which sets out 15 acts that Ukraine needs to implement that contain provisions on the regulation of market behavior of financial market participants.

Financial markets worldwide depend on the level of trust between the public and financial institutions. Population distrust can be influenced by questionable practices used by individual companies and the lack of effective consumer protection. Therefore, the introduction of market behavior regulation in Ukraine will increase confidence in the financial system of Ukraine by ensuring the implementation of sound business behavior, improving the corporate governance of financial market participants and improving the efficiency and reliability of financial service providers.

Yulia Ovdiy, Project and Program Manager of NBU Financial Sector Reform Department.

The analytical article was published in the edition of the CFO of the company, # 6/2019 .