The NBU will set uniform requirements for all lessors and require re-registration in financial companies.

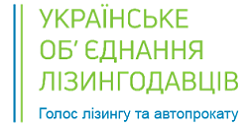

The National Bank, as the future regulator of non-banking financial services markets, has published regulatory approaches and planned changes in the non-banking leasing market.

“In developed countries, financial leasing services are actively used by individuals and businesses as an alternative to bank lending. In Ukraine, the financial leasing market has grown over the past few years and still remains quite small, ”the NBU emphasizes. The main purpose of the regulator is to promote the development of the financial leasing market on the principles of transparency, observance of the rights and interests of clients.

At the end of 2019, leasing services were provided by 439 financial companies and 113 legal entities-lessors. The National Bank proposes to introduce unified, uniform requirements for lessors operating both in the form of financial companies and legal entities licensed for financial leasing. Now the requirements for them are different. The NBU requires all lessors to obtain licenses from the financial company. Current lessors will be re-registered as financial companies with the appropriate type of license.

In general, the requirements for leasing companies will be simplified, as they do not attract funds from the public. But the capital requirements will be maintained. In the case of providing only financial leasing services, companies must maintain equity at UAH 3 million. If the leasing company plans to provide two or more financial services – UAH 5 million.

Sources of financing for leasing companies will be expanded. They will be able to attract funds from affiliates and funds on subordinated debt, including from individuals and legal entities that are qualified investors. They will also be able to raise funds through the issuance of debt securities.

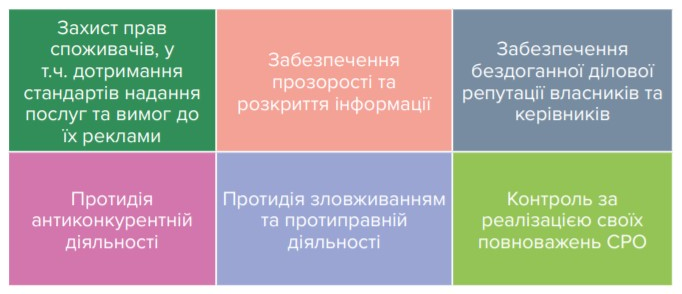

The National Bank will focus on monitoring the market behavior of lessors. In particular, compliance with the following criteria and requirements will be monitored:

Requirements for transparency of companies and preparation and disclosure of reports will be increased. “The development of this market is possible only with the trust of creditors and customers, awareness of the public and business and ensuring compliance with the rights of all parties,” – said the NBU. Therefore, the regulator will require companies to publish reports according to international standards, audited by an independent external audit.

Leasing companies will be required to disclose information required by law, including on their own websites. Detailed requirements will be described in the new law on financial services and financial companies, as well as in the regulations of the NBU.

It will be recalled that the law on “split” provides for the liquidation of the National Commission for Regulation of Financial Services Markets and the division of powers to regulate the financial market between the NBU and the National Commission on Securities and Stock Market from July 1, 2020.

Prepared by LAGA.Money with the support of the USAID Financial Sector Transformation Project.

Source