The National Bank summed up the work of the non-banking market for the first half of 2020. The results of the submitted reports show that the coronary crisis had a moderate impact on the activities of insurers, but had a more significant impact on lending to other non-bank financial institutions.

Insurance market

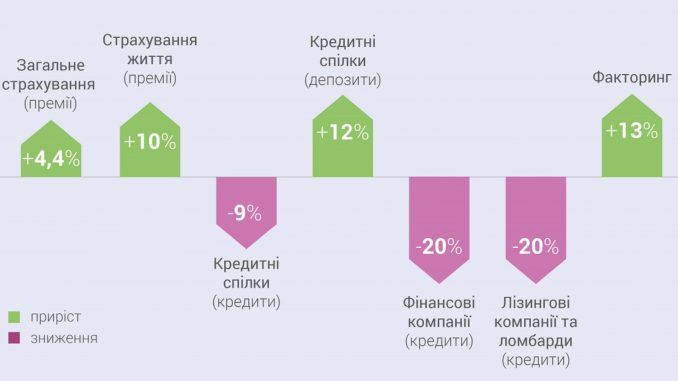

- In the conditions of quarantine measures and reduction of economic activity, insured insurers demonstrated an increase in gross insurance premiums (+ 4.4%) in the first half of the year. The total amount of insurance premiums for the reporting period amounted to UAH 21 billion.

- In general, the amount of collected insurance premiums in the first half of 2020 decreased compared to the same period in 2019. The reason for this was the voluntary withdrawal from the market for the specified period of 20 insurers. Another 6 insurers did not report for the first half of the year, instead in July 2020 they filed applications for revocation of licenses. The share of the latter was about 7% of total insurance premiums.

- The results of the life insurance market showed its steady growth. Life insurance premiums increased by 10% compared to the same period last year and amounted to UAH 2.3 billion.

- As a result, we state that insurers managed to maintain an acceptable financial result by moderately increasing insurance premiums, maintaining stable loss ratios, as well as avoiding the depreciation of assets.

Credit union market

Credit unions proved to be the most vulnerable to quarantine restrictions among other non-banking institutions. Separately about the limitations and negative trends in this market.

- In March 2020, credit unions were classified as institutions whose offices were banned from accepting clients for a certain period. At the legislative level, restrictions have been introduced on the imposition of fines and penalties for late repayment of loans. This, in turn, has led to a deterioration in the quality of the loan portfolio, as traditionally loans from these financial institutions are secured only by guarantees.

- Given the specifics of credit unions, the concentration of their borrowers in one area has exacerbated the negative trends for some of them, in particular for those engaged in agricultural lending.

- In the first half of the year there was a general decline in the financial activity of older people, the number of which among the members of credit unions is quite significant.

- Unwillingness of credit unions to provide remote services, the reason for which is the focus on cash payments and the lack of electronic products and services.

A total of 224 credit unions out of 327 reported to the National Bank. The volume of loans granted in the first half of the year decreased by 9% compared to the same period in 2019. At the same time, the volume of attracted deposits increased by 12% during this period.

Financial companies, pawnshops, lessors

The market for loans to financial companies, which in recent years has grown rapidly by 50 percent or more per year, in the first half of the year showed a decline in performance. The volume of loans granted in the first half of 2020 decreased by 20% compared to the same period last year.

In the first half of 2020, the volume of services provided by leasing companies and pawnshops fell by more than 20% compared to the second half of last year.

In the first half of the year, only the volumes of the factoring market increased (13%).

You can get acquainted with the consolidated indicators of non-bank financial institutions in terms of segments by following the links: