Why do we need a financial leasing market and which model is best for Ukraine

NATALIA PEDOS Leasing Market Development Expert, USAID Financial Sector Transformation Project

The Law on Split provides for a transition period until July 1, 2020 for the transfer of the market regulation function of non-banking financial institutions to the National Bank of Ukraine (NBU). NBU has published White Paper for Financial Leasing, which offered a general vision of the leasing market and the expected positive effects of the changes.

The primary objectives of regulation are to protect the rights of consumers, promote the integrity of the market, its development and ensure competition, including through the facilitation of access to finance.

In general, the leasing industry plays an important role in the European economy, especially in the support and development of small and medium-sized businesses. The economic importance of financial leasing is that it provides capital for investment purposes. This, in turn, promotes a healthy economy, employment and innovation.

According to the study “Access to Enterprise Finance” (SAFE 2019), leasing is the main source of financing for more than 47% of small and medium-sized enterprises (SMEs). Usually about 40% of SMEs do not have access to bank financing.

The European experience is a reference point for Ukraine, which is why countries such as Germany, Poland, Austria and Romania were analyzed in order to select relevant financial leasing market regulation practices.

Licensing and capital requirements

In Germany, financial leasing services are licensed by BaFin, informing the Bundesbank’s regional office about the issuance of licenses. The Law on Banking regulates all financial services, both banks and non-bank financial institutions.

However, the level of requirements is differentiated: for companies that provide financial leasing services, the lowest requirements. And the process of entering the market for them is quick and easy.

In Poland, the leasing market is regulated by general requirements for the activities of economic entities. In Austria, too, there are no special requirements and prohibitions for leasing companies. The activities of leasing companies are regulated by general legislation on economic activity.

The situation is completely different in Romania, where the leasing market is strictly regulated. Financial leasing activities are licensed and supervised by the National Bank of Romania.

The provision of financial leasing services requires a minimum share capital (usually from 200 thousand euros, which is determined individually); there are enhanced requirements for corporate governance (reputational and professional requirements for members of the supervisory board); compliance with financial criteria (working capital, lease transactions, amount of debt, assets, capital), etc. is required.

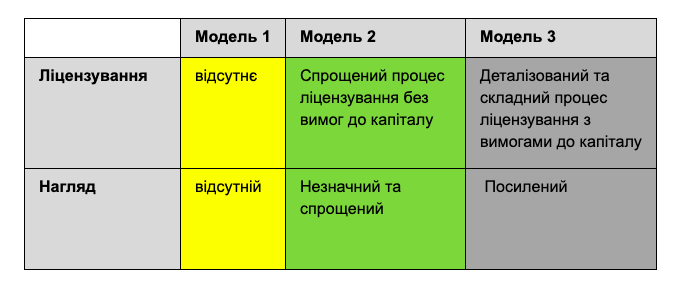

Given the current state of development of the Ukrainian financial leasing market, it is the German balanced model that seems optimal for creating regulatory approaches. (Model 2).

Market regulation should focus on issues such as:

- licensing and capital requirements;

- accounting and taxation;

- corporative management;

- access to finance;

- supervision and reporting;

- self-regulation and the role of the leasing association;

- conditions for exit from the market (bankruptcy or insolvency).

Access to finance

The main obstacle to the development of the financial leasing market in Ukraine is limited access to finance – the regulatory model must take this aspect into account.

In general, in European countries, it is recommended to allow a full range of financial instruments to meet the capital needs of leasing companies, with the exception of raising funds from the general public.

The main sources of financing for the leasing industry are bank loans (including from international and European institutions); issue of shares and bonds, etc.

Securing financing is one of the key challenges for the development of the leasing sector in Ukraine, which is why the National Bank of Ukraine and the Ministry of Finance (as financial distributors under agreements with international financial institutions) have a key role to play in supporting the leasing sector.

For example, to ensure the expected access to finance and to consult with the leasing market, the National Bank of Ukraine may perform data collection and financial reporting to confirm the creditworthiness of lessors to international financial institutions.

What experience of EU countries should Ukraine take into account?

Low risk of leasing activities provides greater availability of financing, in particular for small and medium-sized businesses. And the focus on investing in assets involves long-term business development, which, in turn, contributes to the stabilization of the national economy.

Leasing companies now not only borrow to secure assets, but also provide a full range of services for servicing and using the asset, thus playing an important role in the economy.

The European experience is used as an example for Ukraine, but it is important to keep in mind that in countries with developed economies, the organization of the leasing market changes from time to time. Thus, in Poland, Austria, and Germany, tax privileges for leasing have been reduced in recent years, in fact, due to the steady development of the market.

In the past, such privileges have made a significant contribution to leasing to sustainable economic development. Evidence of this is the Polish market, which in 2018 showed the fastest in Europe (leasing market growth of 22%).

Romania is an example of the negative impact of tighter regulation (tight supervision and tighter corporate governance requirements) and reduced tax benefits, so the leasing market there is not showing the expected growth.

However, given the current state of the leasing market in Ukraine, the complete lack of regulation may pose risks to this market and the full protection of the rights of all its participants precisely because of the unstable economy and unscrupulous players.

Therefore, the best regulatory model is one that contains balanced approaches to ensure development, transparency and confidence in the leasing industry in Ukraine.