Source.

The depreciation of fixed assets of medical institutions in Ukraine exceeds 45%. Clinics lack resources and there is a way out.

VOLODYMIR KUZO Head of Non-Banking Financial Institutions Group, USAID Financial Sector Transformation Project

During 2017-2018, only 93 foreign computed tomographs, 39 MRI devices and about 1 thousand ultrasound devices were purchased in Ukraine.

The volume of medical equipment upgrades is increasing but does not cover the depreciation of hospital fixed assets.

Tools such as financial leasing can accelerate the purchase of new equipment and therefore improve the quality of health care services.

We see new opportunities for the Ukrainian financial sector, private investors and official distributors of equipment in this segment.

The reform of the health care system of Ukraine, the development of private medicine and capital investment in medical infrastructure will lead to increased competition for clients due to their demand for quality medical services.

The healthcare market is growing and needs additional funding

Recently, the Association of Ukrainian Union of Lessors and USAID Financial Sector Transformation Project shared the results of a study of leasing opportunities for medical equipment in Ukraine.

According to the study, health care costs and procurement of medical devices in the world increased by 5.4-5.6% annually from 2016 to 2020, and the equipment market reached $ 440 billion. The volume of the Ukrainian market for 2020 is estimated at $ 494.6 million, its annual growth – 10%.

In Vitro (13% of world sales), cardiology (11.6%) and diagnostic imaging (9.8%) account for the largest share. One of the most popular leasing equipment segments is diagnostic imaging devices: tomographs, mammograms, ultrasound, CT and MRI, radiographs.

At the end of 2017, the overall wear and tear of fixed assets was 45.6% (55.1% overall in Ukraine). A significant obstacle to the renewal of clinics’ fixed assets is the lack of external funding.

Even private clinics are 70% funded with their own funds and only about 8% funded by banks and other institutions. That is, the market is characterized by low penetration of financial services and lack of competition in the health care system.

Soon state-owned medical enterprises may emerge on the market, which will increase competition for funding. The main thing for financial institutions is to start interacting with potential lessees and equipment suppliers.

Recipients of equipment for leasing: revenue, location, facilities

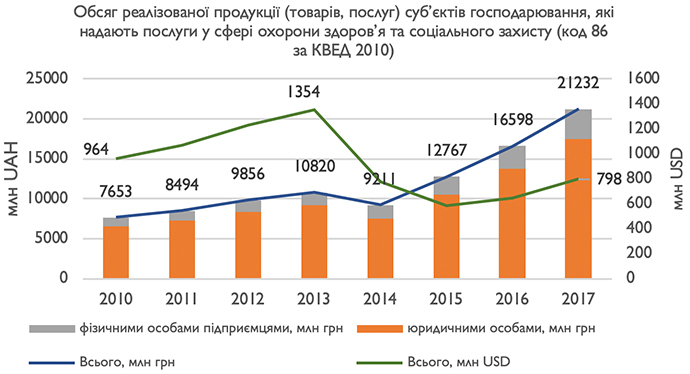

Statistics on the volume of services provided in the healthcare sector indicate that after a critical fall point of 2014, UAH 9.2 billion, the volume of services increased annually by an average of 30%, reaching UAH 21.2 billion in 2017.

At the same time, the relative share of medical services provided by entrepreneurs was increasing. The growth of revenues from services provided to potential lessees, as well as the growth of the entire market, is crucial to ensure the solvency of borrowers.

The growth of the Ukrainian private medicine market is driven by an increase in demand for services, the emergence of new players and an increase in trust in private medicine.

While in Ukraine, medical services were provided by UAH 13.9 billion in 2016, in 2017 this figure increased by 34.3% to UAH 18.7 billion.

The market for private medical services is concentrated in major cities: Kyiv (48.4%), Kharkiv (11.3%), Dnipro (10.4%), Odesa (7%), Lviv (6.6%). It covers both system-wide network facilities (generalist clinics) and small offices.

Medical, retirement and education reforms: do they stand a chance in election year

According to the study, the share of imports of potential leasing objects in Ukraine was 90% of total sales.

The largest suppliers are China, USA, Germany and Japan. The most popular categories are diagnostic imaging equipment (ultrasound, CT, MRI, X-ray), laser surgical equipment, dental and therapeutic equipment.

We expect the equipment market to grow by 5% annually. Trademarks of high quality equipment include Siemens Healthineers, Philips, Canon.

Leasing equipment suppliers: business model, financing mechanism

There are no clinics among the largest importers of medical equipment, which shows a clear structuring of the market and outlined specialization of its participants. For the most part, importing companies also distribute equipment.

The business model of the importing companies is standard and unified and includes the following stages: search of business partners abroad, building business relations with buyers of equipment in Ukraine, supply of equipment and its customs clearance, training of medical personnel, warranty and after-sales service, updating and modification of the sold equipment according to the manufacturer’s policy.

Importers point out that 70-80% of buyers (private medical institutions) ask for financing or deferral of payments when concluding an agreement because of lack of working capital and low availability of bank loans in the industry.

The standard payment mechanism limits the volume of purchases, since it provides for 25-50% advance payment and maximum delay of payment of the balance in equal parts from three to six months after delivery and installation for the equipment.

The healthcare market in Ukraine is growing and facilitating the collaboration of leasing companies with healthcare facilities and equipment suppliers.

The first step in developing this collaboration may be some joint projects to finance the purchase of medical equipment, taking into account the risks and recommendations. The accumulation of statistics and experience in risk management will allow the future to scale leasing financing in the medical field.

Co-author – Natalia Pedos, Leasing Market Development Expert, USAID Financial Sector Transformation Project

The views of the authors expressed in this article do not necessarily reflect those of the US Government and USAID.