July 1, 2020 is an important date in the history of the sector of Ukrainian non-bank financial intermediaries, which include insurance, financial and leasing companies, pawnshops and credit unions, pension funds and their administrators, etc. On this day, their final transition from the supervisory umbrella of the current regulator – Natskomfinposlug – to the sphere of “guardianship” of two other bodies: the National Bank of Ukraine (NBU) and the National Securities and Stock Market Commission (NSSMC) will take place.

At the same time, the liquidation of Natskomfinposlug and the change of supervisory requirements under the law on the split are not the only events that bring non-bank financial institutions into a new reality. With the adoption of the law on financial monitoring, non-banking financial institutions as subjects of primary financial monitoring together with banks should implement a risk-oriented approach and significantly improve KYC-procedures.

Given the tectonic shifts in the non-banking sector, financial analyst YouControl (counterparty verification systems) Roman Kornyliuk decided to investigate how the non-banking financial ecosystem is evolving.

“Blind zone” of the financial sphere

For years, non-bank financial intermediaries have been out of the public spotlight compared to the banking system, which in Ukraine is better developed and banally larger. The banking-centric nature of the Ukrainian financial market is manifested in the fact that as of April 1, 2020, 75 operating banks controlled UAH 2,096 billion in total assets, which is 7.5 times more than UAH 278 billion in assets controlled by 2,136 non-banking intermediaries.

In this review, the list of non-bank financial intermediaries does not include NPF administrators, trust companies, as well as financial institutions that are not under the supervision of Natskomfinposlug (CII).

In the “shadows” of the banking sector, other financial institutions still operate in a low level of transparency and fragmentation of information about the non-banking market, which often disorients customers and partners. After all, the choice of insurance or leasing company has to be based not so much on officially confirmed data, but on the advice of acquaintances or loud and often misleading advertising.

Instead of an unbiased comparison of the financial condition of financial institutions, we have to form important financial decisions about cooperation with such counterparties on the “loose sands” of other people’s experience, subjective promises, assumptions and assumptions.

The problem of finding reliable partners in these markets is complicated by the fact that over the past 30 years the non-bank financial intermediary sector of Ukraine has been actively used not only to provide classic financial services, but also a quiet haven for fans of circuit transactions aimed at concealing transactions, minimizing and evading from taxation, money laundering and even the financing of terrorism or illegal trade.

Instead of performing the functions of financial intermediation and redistribution of risks, a significant part of the non-banking sector acted as settlement and cash centers for the shadow economy or lent to the segment of unreliable customers who did not meet the increasingly strict standards of banks. The key task of the reform of split and financial innovations is to finally close these loopholes, bringing the market to a transparent and civilized form in terms of regulation and supervision.

Who is who: which non-bank financial intermediaries operate in Ukraine?

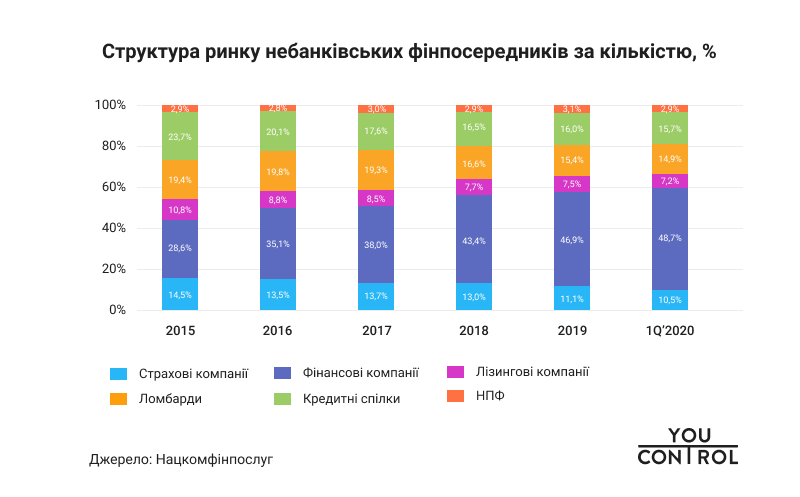

The number of participants in key sectors of the non-banking market of financial intermediaries has decreased by 14% over the past five years – to 2136 companies. The net decline in the number of credit unions and leasing companies exceeded 40%, insurance companies decreased by 38%, pawnshops – by 34%, while the number of financial companies increased by 46% between 2015 and the end of the first quarter of 2020.

As a result of regulatory actions of Natskomfinposlug to clean the financial services market in 2019, 260 weak and unreliable companies were withdrawn, while the net decrease in the number of financial institutions was only 65, which indicates an active parallel process of creating new financial intermediaries.

As a result of regulatory actions of Natskomfinposlug to clean the financial services market in 2019, 260 weak and unreliable companies were withdrawn, while the net decrease in the number of financial institutions was only 65, which indicates an active parallel process of creating new financial intermediaries.

Insurance companies – are financial intermediaries that provide insurance that protect the property interests of individuals and legal entities in case of occurrence of insurance payments and investment income customers. The total number of insurance companies after the crisis of 2014-2015. steadily decreased from 361 to 225 companies on April 1, 2020. However, these mass bankruptcies went virtually unnoticed by most citizens, indicating a significant number of capricious insurers and low penetration of insurance services.

Challenges for the insurance market . The insurance sector, together with credit unions, is included in the NBU’s areas of special attention given the high share of funds raised from people and businesses. Thus, the abnormally low level of insurance payments for unscrupulous players and transit companies, as well as the need for a clear division between the classical and schematic segments of the insurance market – topics that economists have been talking about for decades, but so far little has been done.

Financial companies are non-bank financial institutions that provide credit services to individuals and businesses, but at the same time do not belong to the group of credit unions, pawnshops, insurers, NPFs, etc. The range of services of financial companies is extremely diverse and varies from loans, guarantees, sureties to leasing, factoring, remittances to financing construction projects. This financial services sector has grown the fastest in the last five years: the number of participants has grown from 711 to 1,040 companies, which is almost half of the total number of financial institutions affected by the split reform. A more detailed study showed that a large number of financial companies have the features of “one-day companies” given the age of establishment, not exceeding two years.

Challenges for the financial companies market . The active growth in the popularity of microcredit services provided by financial companies is based on lower standards of control over the reliability of customers compared to banks. The flip side of the coin is the cosmically high credit rates and the high level of complaints about the violation of the rights of borrowers, many of whom fall into debt dependence on such intermediaries and then have serious problems with collectors.

Lessors are legal entities that are not financial institutions under Ukrainian law, but have the legal opportunity to provide financial leasing services. Financial leasing involves the purchase by the lessor of the thing from the supplier and then transfer it to the lessee for a specified period of not less than one year for a fixed fee in the form of regular lease payments on return to the lessor after the lease. Leasing is important for small business development.

Challenges for the leasing market . To increase business opportunities for lessors, the NBU promises to provide them with licenses for money transfer and currency exchange after the split, ie to allow those settlement and cash transactions that already accompany leasing services, but currently require the involvement of partner banks and exchangers, which reduces operating profitability and quality of leasing services.

Pawnshops – financial institutions that provide loans to individuals secured by property from equity or borrowed capital. Pawnshops mainly work with the segment of low-income individuals, meeting their cash needs in times of crisis. A certain segment of pawnshop customers, on the other hand, includes wealthy VIP customers who from time to time had the opportunity to quickly obtain a “live cash” for more loyal confirmation procedures, bypassing strict bank financial monitoring, in exchange for a pledge of a luxury item (expensive watch or jewelry).

Challenges for the pawnshop market. Despite the active expansion, the pawnshop market in Ukraine has gained notoriety due to close ties with the gray sector of the economy, including the gaming sector, through “obnal schemes”, and most importantly – the abuse of low financial awareness of the population. The main claims made by consumers to pawnshops are veiled excessive credit rates and concealment of the real amount of future commission payments that people have to pay in times of financial difficulty.

Credit unions are financial institutions that are based on cooperative principles and whose activity is to attract and pool the monetary contributions of its members to further meet the needs of union members in mutual lending and other financial services. Unlike banks, to take a loan from such an institution, you must become a member. The loan fee under this closed system is transformed into interest income, which each member of the union receives in proportion to the amount of their contributions.

Challenges for the credit union market . The problems of credit unions are very similar to the problems of banks with domestic capital before the banking reform, which began in 2014. The key ones are low levels of capitalization, solvency and transparency, low quality of creditworthiness of borrowers, weak supervision, outright abuse of trust of ordinary depositors, who often lose their savings without the right to compensation, because unions are not members of the Deposit Guarantee Fund.

Non-state pension funds (NPFs) are non-profit financial organizations that operate solely for the purpose of accumulating pension contributions for the benefit of their members, provide services for the management of accumulated pension assets and the implementation of pension benefits. Administrators of non-state pension funds are legal entities that manage the assets accumulated in the NPF and act on behalf of the pension fund and in the interests of its members.

Challenges for the pension market . NPFs, unlike other financial intermediaries, will be supervised not by the NBU but by the NSSMC. This is a logical step, because the economic essence of the work of pension funds is similar to the mechanism of operation of mutual investment institutions (CII) – investment funds, which also work with pools of assets. The main barriers to NPF development are unrealized pension reform, lack of opportunities for domestic investment in Ukraine, high levels of long-term macroeconomic uncertainty, and, as a result, public distrust and a weak culture of voluntary pension contributions.

Asset dynamics: rapid growth

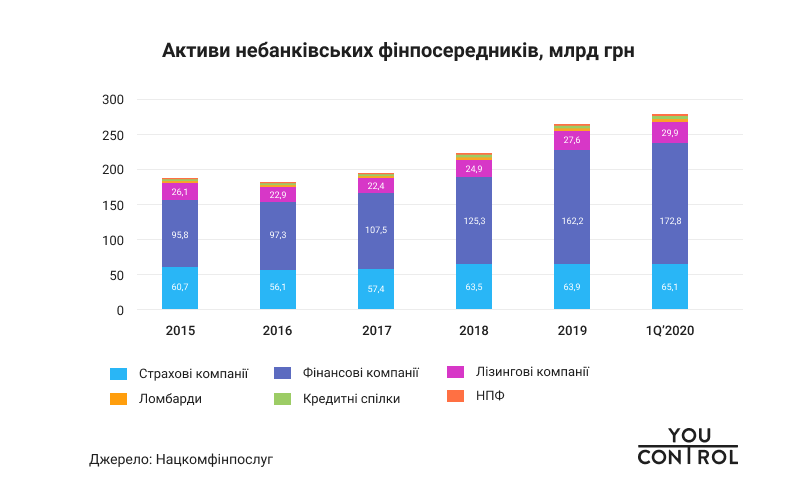

According to Natskomfinposlug, the total assets of all types of financial intermediaries after the systemic crisis of 2014-2016 show accelerated growth from UAH 183.8 billion at the end of 2016 to UAH 277.9 billion on April 1, 2020. The total increase in assets of such financial intermediaries as insurance companies, financial companies, leasing companies, pawnshops, credit unions, NPFs over the past five years amounted to 47.1% (for comparison: the total assets of the banking system during this time increased by 33.4 %). This indicates a significant potential for increasing non-bank financial activity, which is in line with global trends.

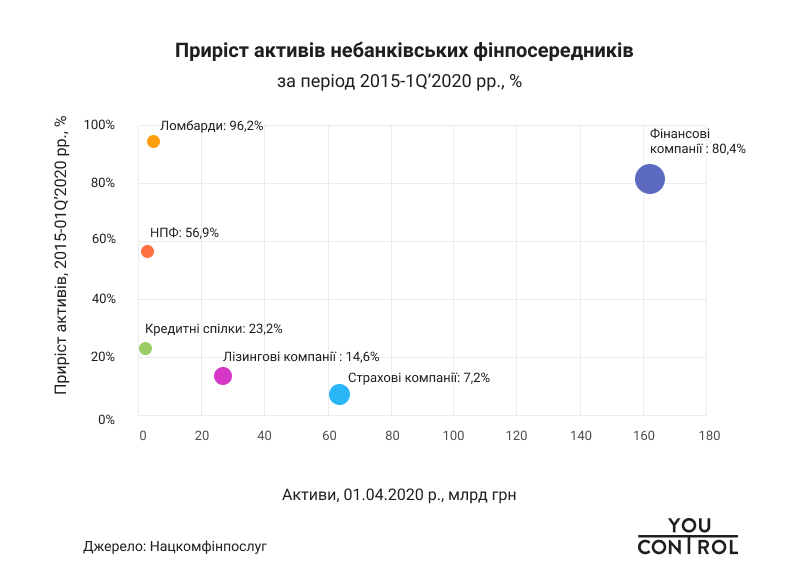

Despite the fact that there are significant differences between the growth rates of different markets of the non-banking financial sector, none of them has experienced a reduction in assets, if we take 2015 as a starting point. The market of financial companies grew the most in five years, both in absolute terms, generating an additional UAH 77 billion in assets, and in relative terms (+ 80.4%). The pawnshop market (+ 96.2%) and NPFs (+ 56.9%) developed rather quickly after the crisis, credit unions (+ 23.2%) developed somewhat more slowly, but the total capacity of these sectors still remains low – at the level of 3- UAH 4 billion, which is equal to the assets of one average Ukrainian bank.

Despite the fact that there are significant differences between the growth rates of different markets of the non-banking financial sector, none of them has experienced a reduction in assets, if we take 2015 as a starting point. The market of financial companies grew the most in five years, both in absolute terms, generating an additional UAH 77 billion in assets, and in relative terms (+ 80.4%). The pawnshop market (+ 96.2%) and NPFs (+ 56.9%) developed rather quickly after the crisis, credit unions (+ 23.2%) developed somewhat more slowly, but the total capacity of these sectors still remains low – at the level of 3- UAH 4 billion, which is equal to the assets of one average Ukrainian bank.

At first glance, the weak growth rate of assets of insurance companies and lessors at the level of 7-15% over the last five years is of some concern. However, it should be emphasized that other indicators of the capacity of these markets look more optimistic: in particular, the amount of gross insurance premiums for this period increased by 78.2% – to 53 billion UAH at the beginning of 2020. One of the reasons for such discrepancies may be a certain increase in regulatory pressure to better assess the assets of insurers and reduce the quantitative composition of the market by more than a third due to the bankruptcy of unreliable and capricious institutions.

The concentration is slowly increasing

As you can see, the most noticeable trends in non-banking financial intermediation in Ukraine over the past five years – reducing the number and growth of assets and incomes of market participants – indicate processes of concentration and consolidation , which are still quite slow and with some delay compared to the banking market. After the crisis, a significant number of small, captive and financially weaker financial institutions were forced to leave the market. According to experts, the split intensifies these processes: powerful companies will continue to operate in the market, forming the backbone of the future financial ecosystem.

Somewhat specific trends are observed in the financial companies sector, which in recent years has grown not only in terms of controlled assets, but also in terms of the number of players (despite the closure of 110 companies in 2019). The emergence of new financial companies has been facilitated by regulatory arbitrage through the transformation of some small banks into financial companies through increased supervision in the banking system, as well as the difficulty of obtaining a banking license in today’s regulatory environment.

In fact, the market finkompany was the most striking manifestation of the so-called shadow banking system (shadow banking) in Ukraine, where the traditional functions of banks, especially in the segment of credit intermediation performed by financial institutions outside the perimeter of banking regulation. However, after the split, financial companies will also be under the supervision of the NBU, which will certainly raise the question of the meaning of the continued existence of many of them in terms of weakening the differences between the regulatory regimes of banking and non-banking.

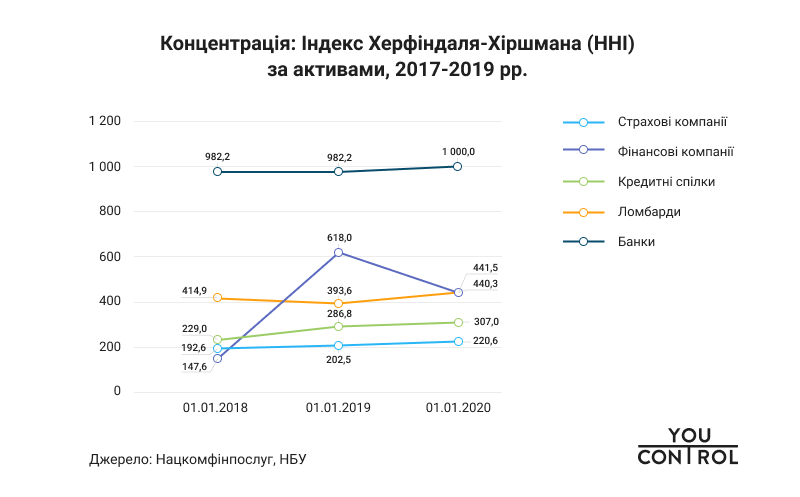

Public data in terms of individual financial institutions, published by Natskomfinposlug, is not enough for a full historical analysis of the dynamics of concentration in the markets of financial products, because the site could find such information only for 2017-2019.

If we evaluate the classic concentration indicator – Herfindahl-Hirschman index (HHI) for this well-known three-year period, we can see that the main markets for non-banking financial services are extremely fragmented with a low level of concentration in the range of 200-500 HHI, which is many times lower than in the banking sector, which balances at the border of the low and moderate concentration zone of 1000 HHI. The exception is the NPF sector, where due to several major market leaders, the concentration has reached 2482 HHI, which is considered a high level of industry concentration.

The financial companies market has increased concentration both on the Herfindahl-Hirschman index and on the share of the five largest companies in assets (CR5), which increased from 19% to 30% in 2017-2019, but in general the market remains very fragmented and highly competitive . Less radical gradual changes in the direction of increasing concentration are observed in the markets of insurers (CR5 = 22.8%), credit unions (CR5 = 29.8%) and pawnshops (CR5 = 37.4%). Thus, most sectors of the non-banking market have ample room for further concentration and consolidation, which will make its key players more visible in the economic landscape than is the case today.

Profitability in question

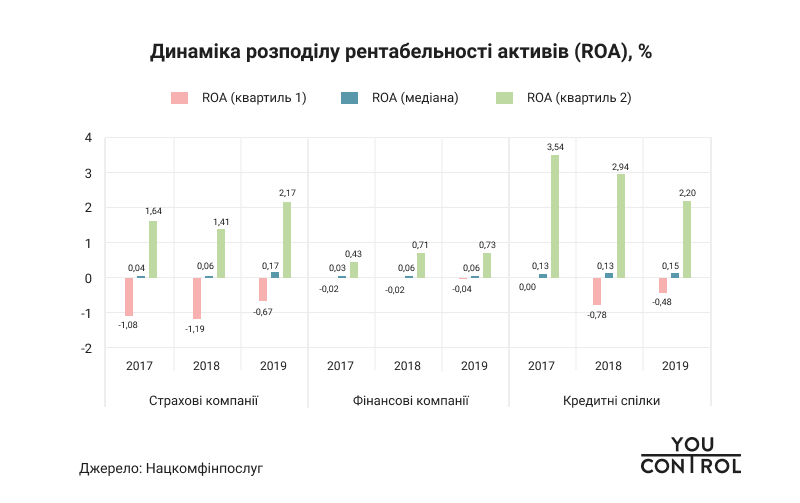

An important indicator of market efficiency is the indicators of profitability, in particular ROA – return on assets, or the ratio between the financial result and the company’s assets. Average profitability indicators and their distribution within each market of non-banking financial institutions show not very active, but still upward dynamics during 2017-2019 in the markets of insurers (growth from 0.04% to 0.17%), financial companies (from 0, 03% to 0.06%) and credit unions (from 0.13% to 0.15%).

On the positive side, the median profitability of these sectors over the past three years has been above zero, which indicates the profitability of most participants in the represented markets. On the other hand, in comparison with the banking sector, whose average return on assets varies from 1.5% in local banks to 3% in foreign ones, the median indicators of non-banking market players at 0.06-0.17% seem to be slightly lower.

It should be emphasized that the profitability of insurance companies and credit unions varies widely. Thus, at the beginning of 2020, the least successful quarter of insurers (1st quartile) reported losses at the level of 0.67% of assets and below, while 25% of the most profitable (3rd quartile) recorded ROA above 2.17%. And half of the “average” credit unions show ROA from (-0.5%) to 2.2%.

At the same time, financial companies report a smaller spread of profitability – from (-0.04%) in the first quartile to 0.73% – in the third. As we can see, a relatively smaller share of financial companies recorded losses, but the profits of most of them were close to zero.

Despite low profitability, non-bank financial institutions managed to bring UAH 1.763 billion to the state and local budgets in 2019 by transferring income tax, which is 28.3% more than a year ago. However, 76.5% of these payments were generated by insurance companies, while other financial institutions, especially financial companies, despite less active business expansion, remain less significant taxpayers.

Conclusions and recommendations

1. The market of non-banking financial intermediaries shows accelerated growth rates during 2017-2020 , but still remains 7.5 times smaller than the banking sector in terms of assets. In the run-up to the reform, split financial institutions appear to be less market-strong and transparent, playing an important but less prominent role in the country’s financial system than banks.

2. The market is saturated with a large number of weak, undercapitalized and unreliable financial intermediaries, many of which instead of performing classic insurance or credit functions for the general population are used as captive legal entities in various optimization transactions in favor of affiliated financial and industrial groups.

3. The largest growing segments of the non-banking market are financial companies and pawnshops , which have managed to increase total assets by 80% and 96% respectively over the past five years. At the same time, their profitability indicators and the amount of taxes paid lag significantly behind not only banks but also insurers. Increasing transparency, the introduction of effective supervision, strengthening consumer protection and the level of financial awareness of customers in the microcredit segment remain key challenges for the reform of the split, given the significant social impact.

4. The insurance market , compared to other financial institutions, seems to be the most powerful, structured, transparent and key taxpayer, but is developing more slowly in terms of asset growth. The weak rates of development of credit unions , leasing and private pension markets in both quantitative and qualitative terms deserve attention of financial regulators , which is connected with chronic problems of development of the real sector of the economy, lack of liquid stock market and barriers to credit resumption. reduced to the rule of law.

5. The concentration of most non-bank financial markets is quite low . Theoretically, this should indicate a high level of competition, but in practice it is only a reflection of high fragmentation and heterogeneity of market players, including a large number of so-called one-day companies, captives and simply financially weak institutions, characterized by high bankruptcies and risk. This strongly influences the perception of markets in the public consciousness, because the information negative in non-transparent conditions is transmitted to the reputation of even those institutions that provide classic financial services in good faith. Therefore, market consolidation and tidying up in the sub-sector of “financial companies – shells” can also bring significant benefits to the economy.

6. The market is informationally opaque . At present, it is difficult to find enough news or analytical information about the non-banking market in the media, and statistical reports from the financial regulator seem rather fragmentary and incomplete. For example, there is no consolidated information on the financial results of all existing types of financial intermediaries, it is difficult to find an official consolidated revenue of the most prominent segment of non-banks – financial companies, not to mention the full publication of all forms of financial reporting at least consolidated over a long period.

Regulators’ openness of this data on socially important segments of the financial sector will be a normal practice to which analysts and clients are already accustomed. After all, unlike financial institutions, they have the opportunity to make their own assessment of the financial condition of banks on the basis of information that is regularly published by the NBU. The positive experience of establishing transparency in the banking system should be extended to all types of financial institutions, if we really strive for financial stability and reduce the number of abuses in the non-banking market.

Source