[

Thursday, January 16, 2020 10:52 AM Posted by Finance Club

The National Bank, the National Securities and Stock Market Commission, the National Commission for Financial Regulation, the Ministry of Finance and the Deposit Guarantee Fund have approved the Financial Sector Development Strategy for 2025.

This is stated in the message of the NBU, which broadcasts a presentation of the strategy.

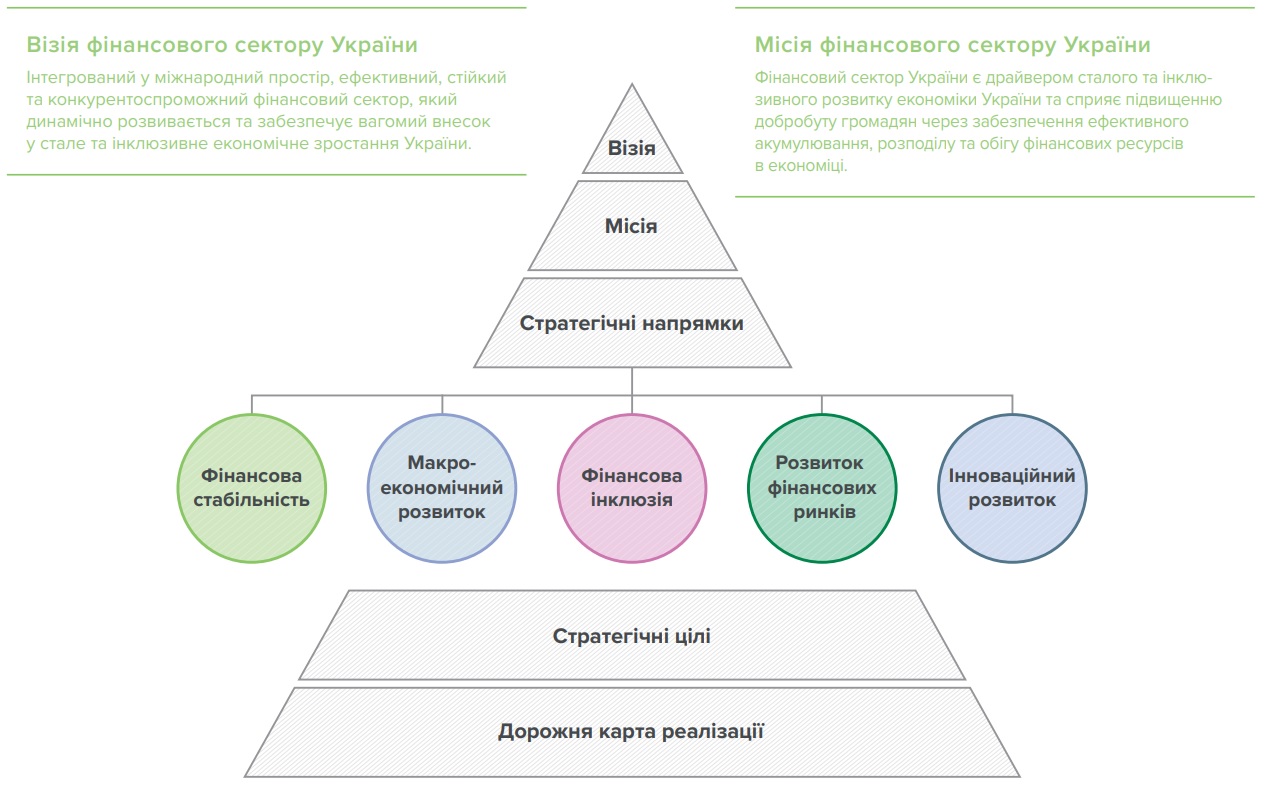

The purpose of the Strategy is to ensure further reform and development of the country’s financial sector in accordance with the leading international practices and implementation of the measures envisaged by the EU-Ukraine Association Agreement and other international commitments of Ukraine.

It will take the place of the Comprehensive Financial Sector Development Program by 2020, which has prioritized regulatory reform over the past five years. The strategy envisages the development of the financial sector in five main areas:

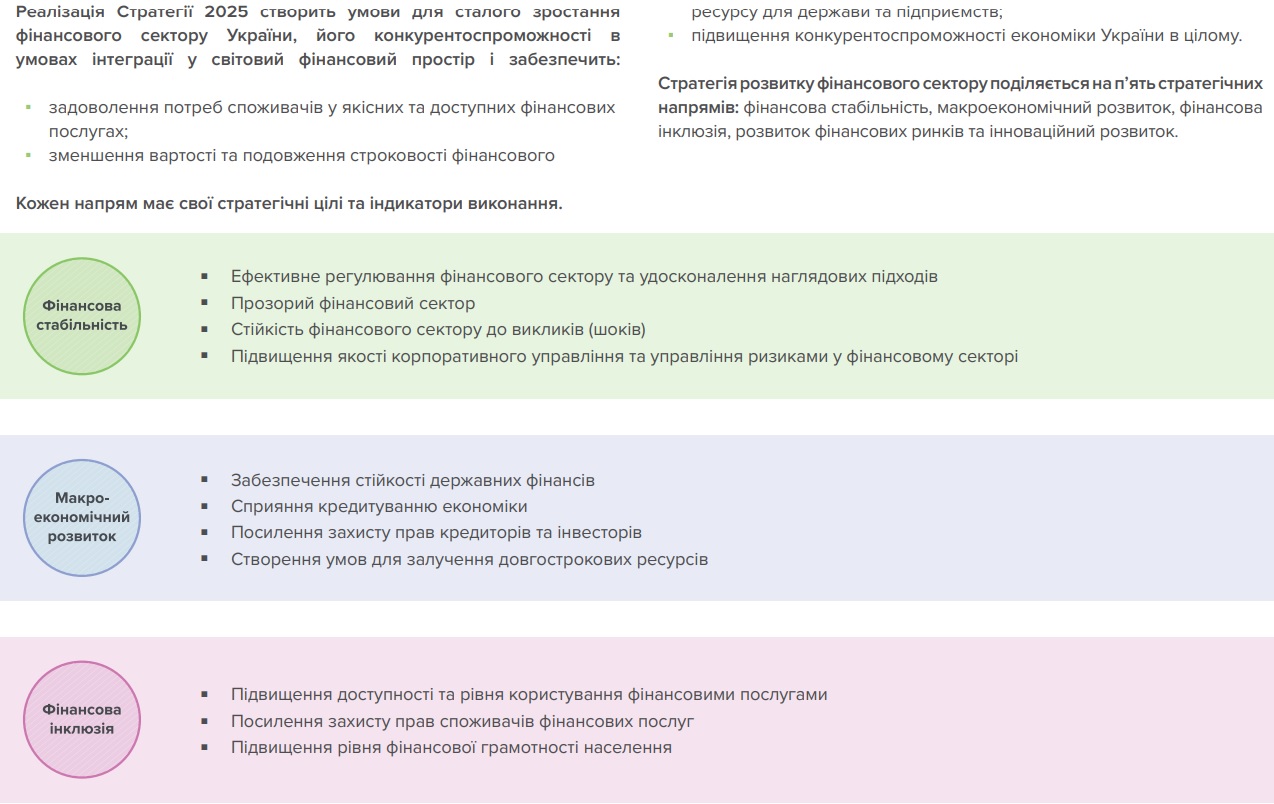

– strengthening financial stability;

– promotion of macroeconomic development and economic growth;

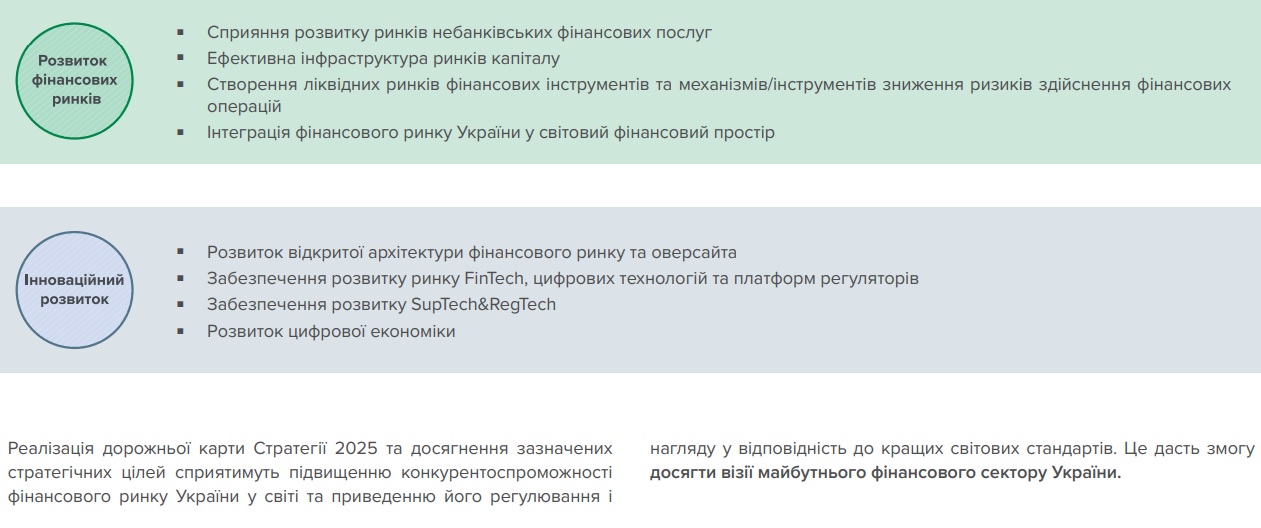

– development of financial markets;

– expansion of financial inclusion;

– introduction of innovations in the financial sector.

To further strengthen financial stability, regulators will, among other things, focus their efforts on enhancing the protection of creditors and investors’ rights, introducing a BEPS plan of action, enhancing corporate governance in financial institutions, strengthening the requirements for their internal controls, improving the deposit guarantee system, and eliminating insolvent financial institutions. , implementing risk-oriented supervision of non-banking financial institutions, regulatory and regulatory oversight requirements anchors and non-banking financial institutions as provided for in the EU-Ukraine Association Agreement, etc.

Macroeconomic development will be stimulated by intensifying lending to small and medium-sized enterprises, in particular land-based farms, removing obstacles to restarting mortgage lending, and export financing.

Other important tasks in this area are prudent fiscal policy, development of the non-bank lending market, enhanced coordination of actions of the Ministry of Finance and the National Bank, introduction of level II and improvement of regulation of the third level of the pension system, development of the internal market of government securities.

To develop the financial markets, regulators will work to complete currency liberalization, create liquid markets for financial instruments (derivatives, corporate stocks and bonds, etc.), deregulate markets for low-risk non-banking financial services or those that do not comply with EU practices, regulate insurance activities II and IAIS principles, ensuring the legal regulation of insurance intermediaries, creating at the legislative level the necessary prerequisites for the development of credit markets their unions and provision of financial leasing services, modernization of stock exchange and depository infrastructure, creation of a comprehensive stock market monitoring information system, application of international standards of functioning of capital markets infrastructure (requirements CSDR, EMIR, MIFID II, MIFIR, PFM) and more.

In order to enhance financial inclusion, financial institutions’ market conduct standards and financial products disclosure will be implemented, targeted programs for increasing financial literacy of the population will be strengthened, consumer rights will be strengthened, incentives will be created for payment infrastructure for non-cash transactions, and the system will be expanded and improved contributions, etc.

Innovations in the financial sector will cover a wide range of actions, including the development of a BankID remote identification system, the creation of a crowdfunding and venture capital platform, as well as sandbox-type regulatory sandboxes, the introduction of new payment and transfer technologies, financial access for participants markets to public registers, the development of big data, blockchain and cloud technologies and more.

Thus, the Strategy envisages reforms in all segments of the financial sector: in the banking market, in the non-banking financial institutions sector, in the capital markets. The implementation of the Strategy will create a transparent, competitive, stable and high-tech financial sector in five years.

In such circumstances, it will become a driver of sustainable and inclusive development of the Ukrainian economy and will contribute to improving the well-being of citizens through efficient accumulation and redistribution of financial resources in the economy.

The strategy was presented on January 16, 2020 with the assistance of the USAID Financial Sector Transformation Project.

The document was signed by NBU Chairman Yakov Smoly, Minister of Finance Oksana Markarova, Head of the National Securities and Stock Market Commission Timur Khromayev, Managing Director of FSUE Svetlana Recruit, Member of the National Financial Services Commission Denis Yastreb.